Renters Insurance in and around Cedartown

Cedartown renters, State Farm has insurance for you, too

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

Protecting What You Own In Your Rental Home

It's not just the structure that makes the home, it's also what's inside. So, even if your home is a rented apartment or property, renters insurance can be a good idea to protect your stuff, including your smartphone, video games, running shoes, tools, and more.

Cedartown renters, State Farm has insurance for you, too

Renting a home? Insure what you own.

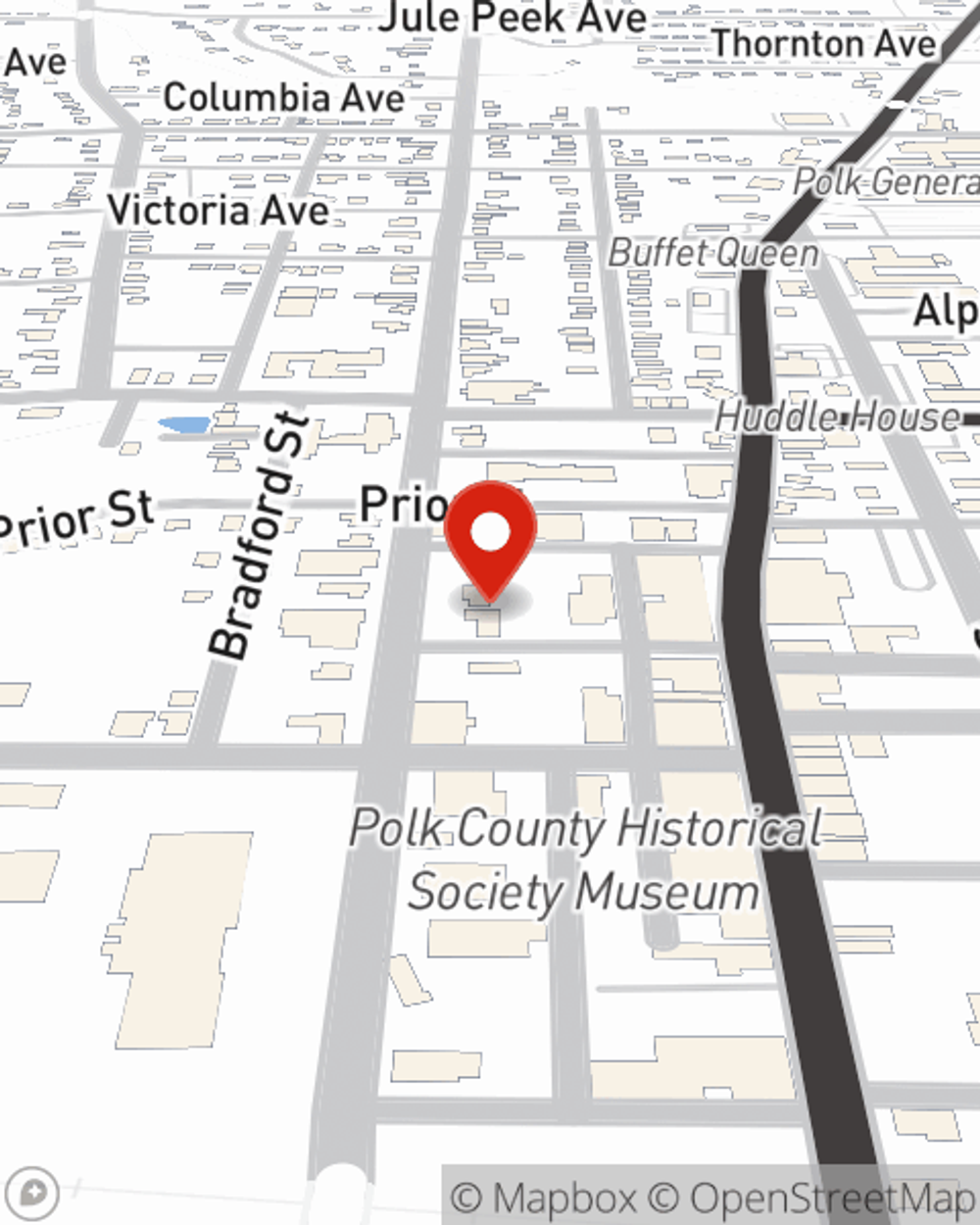

There's No Place Like Home

Renting is the smart choice for lots of people in Cedartown. Whether that’s a house, a townhome, or an apartment, your rental is full of personal possessions and property that adds up. That’s why you need renters insurance. While your landlord's insurance probably covers an abrupt leak that causes water damage or smoke damage to the walls, that won't help you replace your possessions. Finding the right coverage helps your Cedartown rental be a sweet place to be. State Farm has coverage options to accommodate your specific needs. Luckily you won’t have to figure that out on your own. With empathy and reliable customer service, Agent Jeff Truitt can walk you through every step to help you build a policy that shields the rental you call home and everything you’ve invested in.

There's no better time than the present! Get in touch with Jeff Truitt's office today to learn how you can protect your belongings with renters insurance.

Have More Questions About Renters Insurance?

Call Jeff at (770) 748-5952 or visit our FAQ page.

Simple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.

Jeff Truitt

State Farm® Insurance AgentSimple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.